A lot can happen in 40 days. Why such a specific number? That’s the average length of time between putting an offer on a home and the deed recording. The Cameron Team has been in the real estate business for over 20 years. In that time, we’ve seen buyers put offers on homes and suddenly face a whole slew of problems – divorce, job loss, financial pitfalls, a death in the family, and more. In a strange way, it’s a reminder of how quickly life changes. While some issues are just unavoidable, we’ve seen buyers make some avoidable mistakes and that’s a reminder of how important it is to stick to closing guidelines when buying a home.

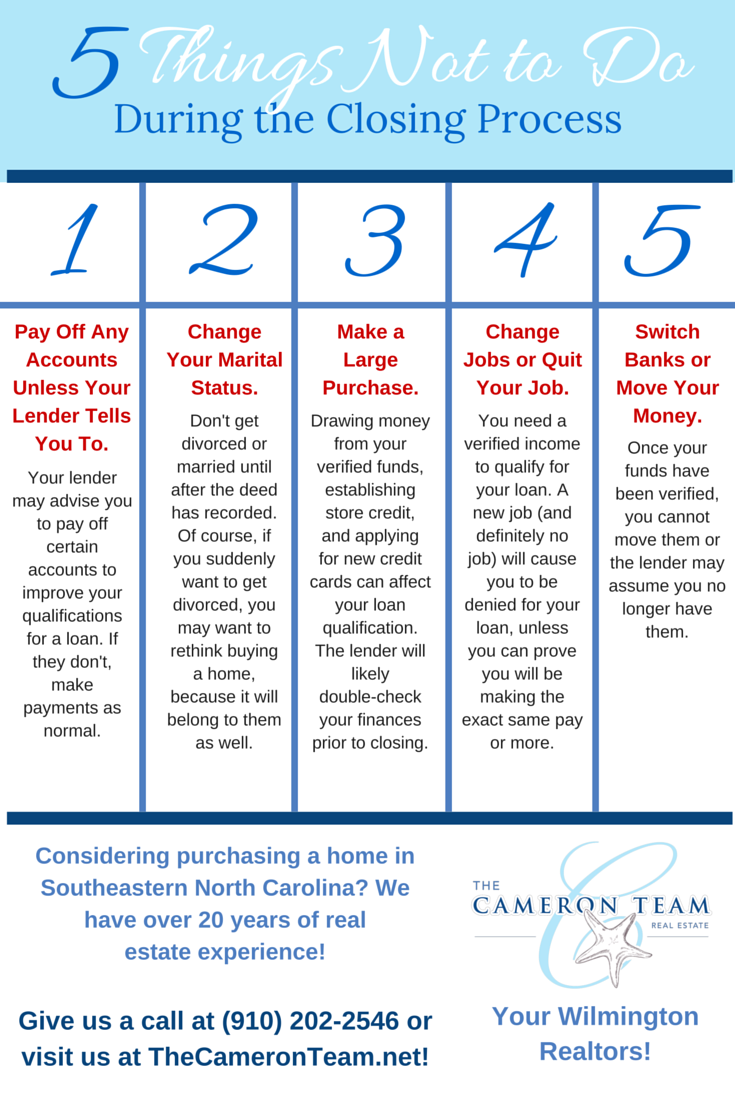

The Closing Guidelines

All lenders must stick to a specific timeline established by the Consumer Financial Protection Bureau. This timeline requires lenders to provide loan disclosures to buyers in a timely and consistent manner so that buyers understand financial expectations and responsibility. To the real estate industry, this is known as “TRID”. To consumers, it’s the Know Before You Owe Disclosures. While all lenders are regulated this way, on a more personal level, each loan officer has their own way of handling clients. Some are more hands-on with helping clients straighten out their finances to get the best interest rate and stay on track to closing, others aren’t. But to be clear, there are certain guidelines that all buyers should stick to, because home loans are not guaranteed until all paperwork is signed at the closing table. Certain financial and lifestyle changes that occur after a buyer is approved for a loan can lead to a loan denial. So, here’s what buyers should expect to do once they’ve been pre-approved and an offer has been made on a home.

Do Not Pay Off Any Accounts

The key to a good credit score is having credit lines, using them, and making payments on time. If a buyer pays off a credit line and closes an account ahead of schedule, they would have one less line of credit and their credit score could be negatively impacted. Buyers need to remember that lenders are in the business to make money. They do that through interest. If that opportunity it removed, it may mean the buyer is paying less, but it also warns other lenders that the buyer may not be the best investment.

While buying a home, it’s best to pay bills on time, but not rush to pay anything off, unless the lender/loan officer says so. They may make suggestions early in the loan process to help buyers increase their credit scores and get a better interest rate or loan package. If a credit line is due to be paid off during the purchase timeframe, it’s okay to do so, because those were the terms agreed upon. Whatever you do, don’t skip a payment to try and stretch out the lifespan of a credit line.

Do Not Change Your Marital Status

We are not lawyers and cannot give you legal advice, but general knowledge states that loan approval is usually based upon combined income and both credit scores. If a buyer gets married and the spouse was not included on the original approval, they may need to be re-approved with the spouse’s financial information. If the spouse has a lower credit score, this could negatively impact the loan terms. If the spouse has a better credit score, you may want to be re-approved, because it could mean a lower interest rate and/or payment. Your lender/loan officer would be able to advise you on the best course of action.

If the buyers decide to divorce after making an offer and one party decides to go through with the purchase, they will need to prove that they can afford to own the home after divorce. This can get a little messy, especially if terms of divorce are not agreed upon prior to closing. Again, we are not lawyers, but it’s important to understand that in North Carolina it takes one person to buy, two to sell. If a home is purchased prior to divorce, it could be considered part of the marital estate and affect how assets are divided. Prior to continuing with the purchase, the buyer should contact a lawyer.

Do Not Make a Large Purchase

Making a large purchase during the loan process can affect you in two ways. If a buyer has provided bank statements to the lender showing that they have a certain amount of funds in their savings account and then withdraw money from those funds, it will likely disqualify them from the loan. Those funds are security for the loan. When the lender sees them, they assume that the buyer has enough money for the down payment and future payments on the loan. If those funds disappear, it negates that assumption.

Oftentimes, large purchases also come with new loans i.e. new credit lines. This is considered debt and will throw off the debt to income ratio used by the lender to determine a buyer’s ability to afford a home loan. So, if a buyer is suddenly without a car and need a new one, is best for them to borrow a car, get a loan from a family member, or carpool until after closing. It’s also important to note that large purchases include furniture and appliances for the new home. Store credit is not an exception.

Do Not Change or Quit Jobs

It’s probably obvious that it’s not a good idea for a buyer to quit their job (or get fired) when buying a home. After all, that would mean a loss of income. However, buyers don’t always consider a job change as an issue, but it is. When a buyer applies for a home loan, the lender verifies their current income by looking at a provided history. With a new job, there is no history, so no guarantee. It’s especially troubling when the buyer changes industries (example: a high school teacher becomes a Realtor). In order to make a job change viable, it would need to be from a job at one company to the exact same position or better at another company (example: store manager at Harris Teeter to store manager at Lowe’s Foods), and the company would have to provide some serious documentation showing that they plan to pay the buyer the same or more than their old job.

Do Not Switch Banks or Move Your Money

Lenders don’t like to see money moved around accounts. They consider it suspicious activity. They want to see nothing less than the original figures, under the same account number. A buyer should have all their finances in order prior to making an offer on a home. It’s best for the buyer to put all the money they plan on using to buy the home into an account separate from the one used for daily expenses and leave it there untouched until closing happens. This will prevent a lot of headache later on.

Conclusion

Purchasing a home is a big milestone and investment. One misstep can ruin the terms of the buyer’s loan and their chances of buying, so following the guidelines above and listening to their lender is very important. The whole plan boils down to two things: 1) have your finances prepared prior to applying for a loan and 2) touch nothing until after the closing. It’s all about self-control, making educated choices, and accepting there may be some sacrifices along the way. In the end, it’s worth it.

If you have any questions about buying a home in the Wilmington area or need a referral for a reputable lender, give us a call at (910) 202-2546 or send us a message through our Contact page. We’re here to help!