In today’s dynamic real estate landscape, homeowners are increasingly looking for ways to make their properties work harder for them. Whether it’s for renovating your home, consolidating debt, or investing in new opportunities, tapping into your home’s equity can be a smart financial strategy. But what exactly is home equity, and how can you leverage it effectively? This guide will walk you through the process, highlighting tools like Homebot that can help you make informed decisions.

Understanding Home Equity

At its core, home equity is the difference between your property’s current market value and the amount you owe on your mortgage. It represents the portion of your property that you truly “own.” As you make mortgage payments over time, your equity increases. Additionally, if your home’s value appreciates due to market conditions or improvements you’ve made, your equity grows as well.

Ways to Leverage Your Home’s Equity

Home Equity Loans and Lines of Credit (HELOCs)

A home equity loan offers you a lump sum, which is ideal for significant, one-time expenses. It’s like a second mortgage with a fixed interest rate, meaning your monthly payments remain constant. A HELOC, on the other hand, works more like a credit card, giving you access to a line of credit based on your equity. You can draw from it as needed, making it flexible for ongoing expenses.

Cash-Out Refinance

This involves refinancing your existing mortgage for more than you owe and pocketing the difference. It can be a great way to secure a lower interest rate while accessing your home’s equity in cash. This is particularly appealing for large projects or consolidating high-interest debts.

Investment in Real Estate

Your home’s equity can be a powerful tool for building your investment portfolio. By borrowing against your equity, you can fund the down payment on a rental property, diversifying your income sources and potentially increasing your wealth over time.

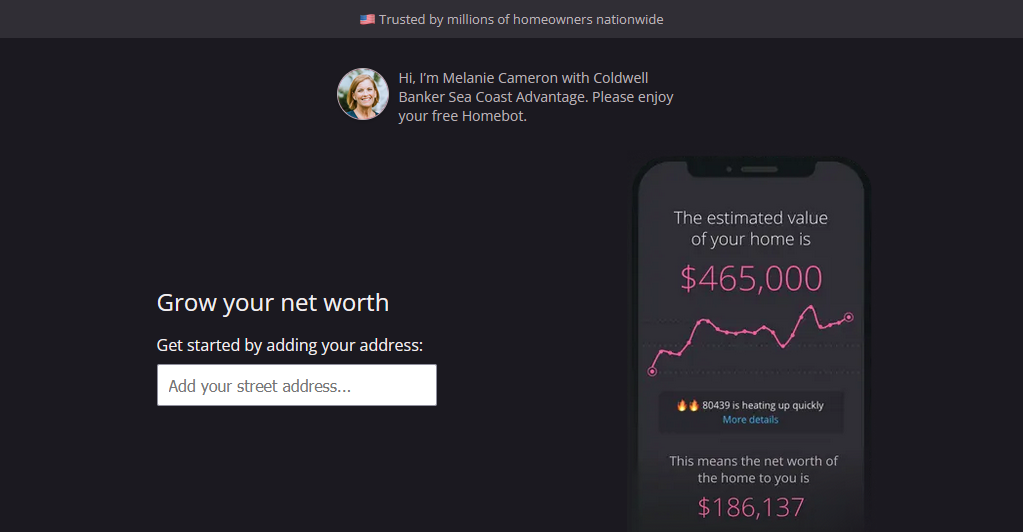

Leveraging Homebot to Maximize Your Home’s Equity

Navigating the complexities of home equity can be daunting. That’s where Homebot comes in. Homebot is a dynamic financial dashboard designed to help homeowners and buyers maximize their wealth. It provides personalized data about your home’s value, equity, and the potential benefits of refinancing, among other financial insights.

Personalized Insights

Homebot delivers monthly reports tailored to your unique situation, giving you a clear view of your home’s current value, equity, and how you might leverage it to your advantage. This can be particularly useful for deciding when to refinance, whether to consider a HELOC, or how to strategically invest in real estate.

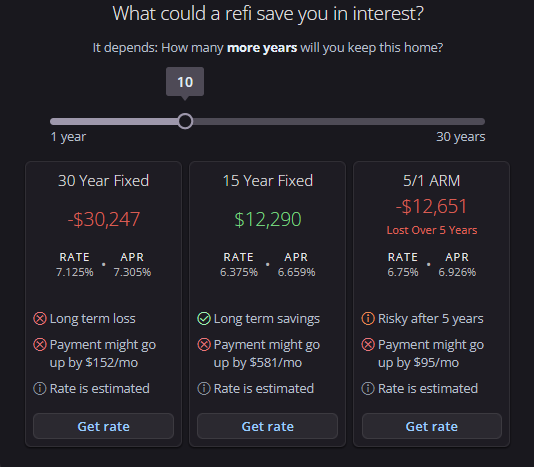

Refinancing Scenarios

Interest rates fluctuate, and knowing when to refinance can save you a significant amount of money. Homebot’s refinancing scenarios take into account your current mortgage details, your home’s equity, and prevailing interest rates to recommend whether refinancing could be beneficial for you.

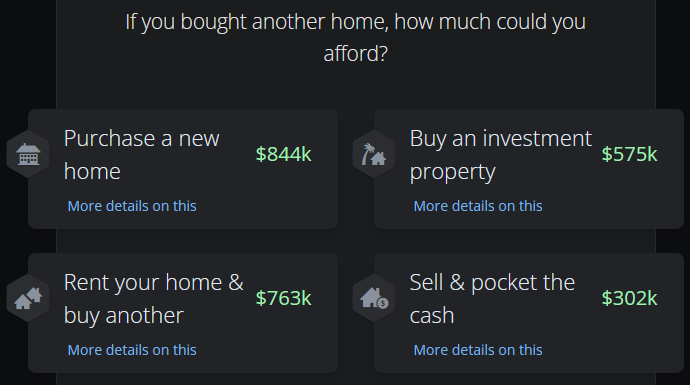

Investment Opportunities

For those interested in using their home’s equity to invest in real estate, Homebot can provide insights into how much you could afford to invest and what your potential returns might look like. This can be a game-changer for expanding your real estate portfolio responsibly.

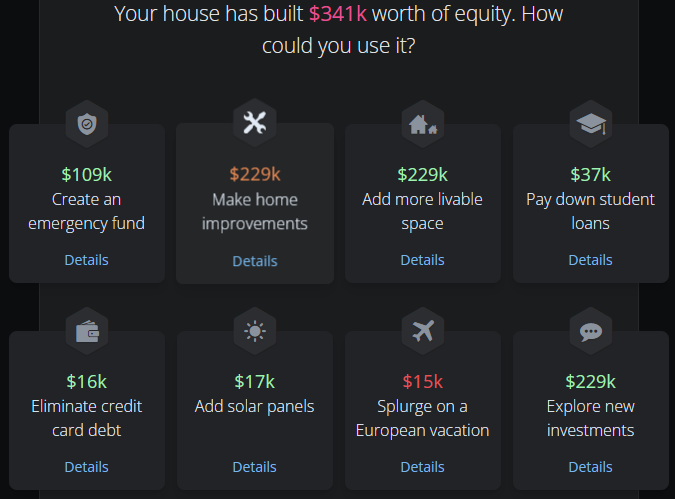

Debt Consolidation

If you’re considering using your home’s equity to consolidate debt, Homebot can help you understand the implications and potential savings. By comparing your current debts with the terms of a potential home equity loan or HELOC, you can make an informed decision that aligns with your financial goals.

The Bottom Line

Leveraging your home’s equity can be a smart move, but it’s not without its risks. It’s crucial to consider your overall financial situation, your ability to repay the borrowed funds, and the impact on your long-term financial health. Tools like Homebot can provide valuable insights, but consulting with a financial advisor or mortgage professional is always a wise step.

As you explore the possibilities, remember that your home is not just a place to live—it’s also a key asset in your financial portfolio. With the right approach, you can unlock its potential and pave the way for a more secure financial future.

For more insights and personalized guidance on leveraging your home’s equity, visit Homebot and discover how it can transform your approach to homeownership and real estate investment.

By integrating strategic financial decisions with innovative tools like Homebot, homeowners can navigate the complexities of real estate investment with confidence, making their homes not just places of comfort and security but also pivotal assets in their journey toward financial freedom and prosperity.