Many people consider adjustable-rate mortgages (ARMs) to be risky investments because the interest rate can change over time. However, there can also be some financial benefits to taking out an adjustable-rate mortgage versus a fixed-rate mortgage. In this blog post, we will examine the pros and cons of adjustable-rate mortgages to help you determine whether or not this is the right type of mortgage for you.

1. What is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage is a type of mortgage loan that offers a lower initial interest rate than a fixed-rate mortgage. However, unlike a fixed-rate mortgage, which has the same rate for the lifetime of the loan, the interest rate on an ARM changes. It has an initial fixed period, which can last 3, 5, or 10 years. After that period, it adjusts periodically, typically every 1 to 5 years. This is based on a financial benchmark, such as the U.S. Treasury or the secured overnight finance rate (SOFR). Whichever benchmark the ARM uses is named within the loan contract.

2. How is an Interest Rate on an Adjustable-Rate Mortgage Set?

The interest rate on an adjustable-rate mortgage (ARM) is set using a predetermined formula that includes an index and a margin. The index is a benchmark interest rate that reflects the general level of interest rates in the economy, and the margin is a fixed percentage rate that the lender adds to the index to determine the final interest rate for the loan.

Here are the steps to calculate the interest rate on an ARM loan:

- Determine the index: The lender selects an index to use for the ARM loan (mentioned above).

- Add the margin: The lender adds a fixed percentage rate to the index to determine the interest rate for the loan. The margin is typically set by the lender and may vary based on the borrower’s creditworthiness.

- Determine the initial interest rate: The initial interest rate on an ARM loan is typically lower than the rate on a fixed-rate mortgage. The initial rate is often determined by adding the margin to the current value of the index.

- Determine the adjustment period: The lender determines how often the interest rate on the ARM loan will adjust.

- Determine the rate cap: The lender sets caps on how much the interest rate can adjust during each adjustment period and over the life of the loan.

After the initial adjustment period, the interest rate on an ARM loan will adjust based on the value of the index at that time, plus the margin. The interest rate on an ARM loan can increase or decrease depending on changes in the index.

You may hear lenders talk about the margin in terms of basis points. These points are the margin percentage multiplied by 100. So, a 2% margin is 200 basis points above the benchmark.

3. Are there Limitations on Adjustable-Rate Mortgages?

Adjustable-rate mortgages typically have caps that limit how much the interest rate can change during each adjustment period or over the life of the loan. There are three types of caps that may be included in an ARM loan:

- Initial Cap: This cap limits the amount that the interest rate can increase or decrease during the initial adjustment period. For example, if the initial cap is set at 2%, then the interest rate can’t increase or decrease by more than 2% during the first adjustment period.

- Periodic Cap: This cap limits the amount that the interest rate can increase or decrease during subsequent adjustment periods. For example, if the periodic cap is set at 1%, then the interest rate can’t increase or decrease by more than 1% during each subsequent adjustment period.

- Lifetime Cap: This cap limits the maximum amount that the interest rate can increase or decrease over the life of the loan. For example, if the lifetime cap is set at 5%, then the interest rate can’t increase or decrease by more than 5% over the entire loan term.

Caps help to limit the risk for borrowers who choose an adjustable-rate mortgage. They provide some protection against large rate increases, making the loan more predictable and manageable. It’s important for borrowers to understand the caps that apply to their ARM loan and to consider how they may impact the monthly payment and overall cost of the loan over time.

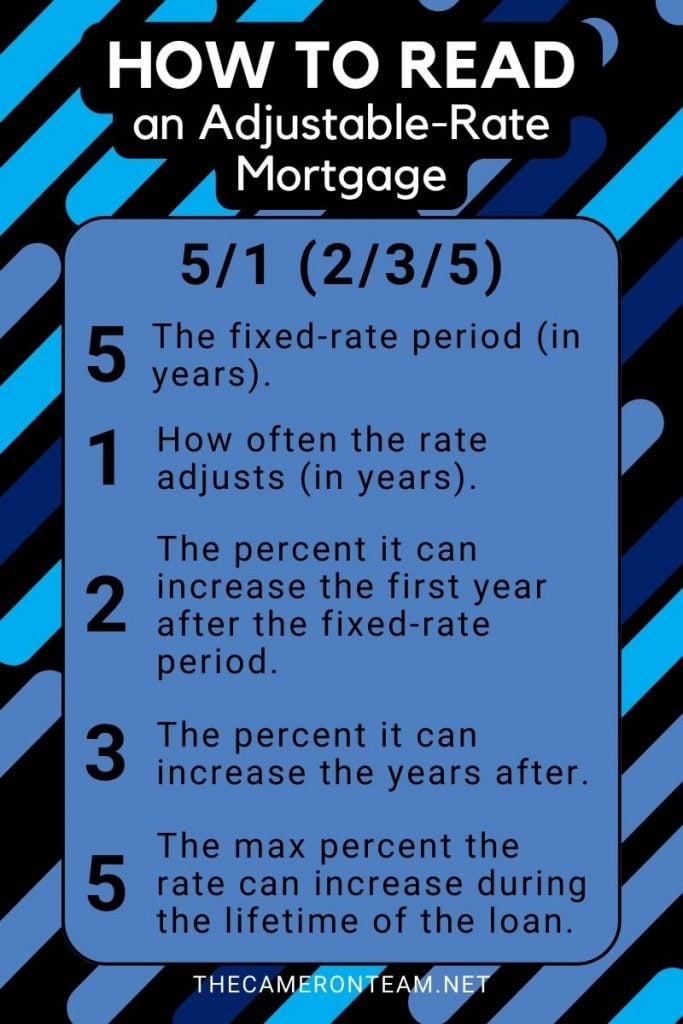

4. What are All These Numbers When I Look Up Adjustable-Rate Mortgages?

The way ARM rates are presented can be confusing for new borrowers. Here’s how to read those numbers:

5/1 or 5/6 ARMs

Both of these types of ARMs start with a 5, which stands for 5 years, the initial fixed-rate period. The second numbers represent how often the rate will adjust after the initial period. In this case, every 1 year or every 6 years.

5/1 (2/3/5)

Sometimes, you’ll see a set of three numbers after the rate periods. The first number stands for how much your interest rate could be changed after the first year (the Initial Cap). In this case, it’s 2%. The second number is how much the interest rate could increase during the following year or any time after (the Periodic Cap). The example is 3%. The third number is how much the interest rate can increase over the lifetime of the loan (the Lifetime Cap) – 5%. If the interest rate goes up 2% the first year after the fixed period and increases 3% the following year, then it would be at its max 5% and cannot increase further.

5. What Does It Mean When It Says a Loan is Conforming or Nonconforming?

Like fixed-rate mortgage, ARMs can also be conforming or nonforming. Here’s what you need to know about each type:

- Conforming ARMs: Conforming loans are mortgage loans that conform to the guidelines set by Fannie Mae and Freddie Mac, the two government-sponsored entities that buy and sell mortgages on the secondary market. Conforming ARMs must meet certain criteria, such as loan limits, down payment requirements, and credit score thresholds. Conforming ARMs typically have lower interest rates than nonconforming ARMs because they are considered less risky to lenders.

- Nonconforming ARMs: Nonconforming loans are mortgage loans that do not meet the guidelines set by Fannie Mae and Freddie Mac. These loans may be referred to as jumbo loans because they are larger than the maximum loan amount allowed for conforming loans. Nonconforming ARMs may have higher interest rates than conforming ARMs, because they are considered riskier to lenders.

Nonconforming ARMs may be harder to qualify for and may come with higher fees and stricter requirements. It’s important for borrowers to read the terms and conditions before committing to one loan or another.

So, are adjustable-rate mortgages bad? The answer is, “it depends.” Here are some advantages and disadvantages to consider:

6. Advantages of an Adjustable-Rate Mortgage

- Lower Initial Interest Rates: The lower initial interest rate on an ARM can make it more affordable for borrowers to buy a home and make lower monthly payments.

- Flexibility: ARM loans can offer borrowers the flexibility to take advantage of lower interest rates in the future. If interest rates fall, the interest rate on an ARM loan will adjust downwards, which means borrowers can save money on their monthly mortgage payment.

- Short-term Solution: ARM loans can be a good short-term solution for borrowers who plan to sell their home or refinance their mortgage before the interest rate adjusts.

7. Disadvantages of an Adjustable-Rate Mortgage

- Uncertainty: The biggest downside of an ARM loan is the uncertainty of future interest rates. If interest rates rise, borrowers will see an increase in their monthly payment, which can cause financial strain.

- Risk: Borrowers with ARM loans are exposed to the risk of higher interest rates in the future, which can make budgeting and financial planning more difficult.

- Lack of Stability: The lack of stability can make it difficult for borrowers to plan for their financial future, especially for those who plan to live in their home for a long time.

8. Who Should Consider an ARM?

Ultimately, whether an adjustable-rate mortgage is bad or good depends on your financial situation and your ability to manage risk. If you are comfortable with the potential for higher monthly payments and the uncertainty of future interest rates, then an ARM loan may be a good option for you. However, if you value stability and certainty, then a fixed-rate mortgage may be a better fit for your financial needs. Whatever you do, choose an ARM based on a hypothetical pay raise or expense decrease that may never come. Consider your finances as they are now.

Adjustable-rate mortgages can be a great option for certain homeowners but are not for everyone. It’s important to understand the risks involved before making a decision about whether or not to take out an ARM. Consider speaking to a financial advisor or doing some research on your own to discover if this type of loan is right for you.

Are you considering purchasing a home? Do you need help understanding the risks and benefits of an adjustable-rate mortgage? We invite you to reach out to us. We will put you in touch with a reputable local lender, who can give you today’s rates and provide valuable information about qualifying for a home loan.